Typical application of special optical fiber in smart grid: all-optical fiber current transformer technology

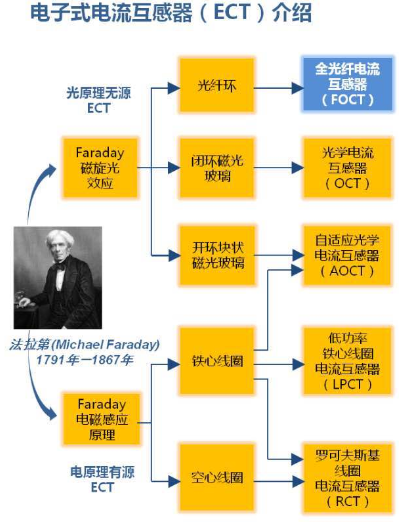

With the improvement of power system voltage level and the increase of transmission capacity, the stable operation of relay protection system becomes more and more important. Electronic current transformer technology has become the main method of current monitoring in high voltage power system. Electronic current transformer technology can be traced back to the magnetic rotation effect and electromagnetic induction discovered by Faraday in the 18th century. Through the special effects of electricity, magnetism and light, it can achieve the purpose of accurate sensing and measurement of high voltage current.

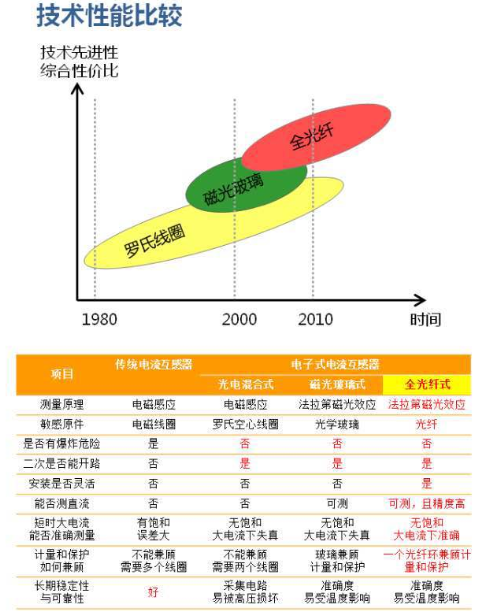

The current mainstream electronic transformers mainly include Rogowski coil current transformers (RCT) based on the principle of electromagnetic induction, magneto-optical glass current transformers (OCT) based on the Faraday magneto-optical effect, and all-optical current transformers (FOCT). For comparison of technical features, see Figure 1 for details.

Figure 1 Electronic transformer and comparison of different technologies

Traditional electromagnetic induction current transformers (RCT) have inevitable defects, such as complex insulation structure, high cost, and large size. Compared with it, the all-fiber current transformer has a series of advantages, such as wide measurement range, high sensitivity, small size, and high safety. Therefore, the all-fiber current mutual inductance technology has received great attention from the industry and has developed rapidly in recent years.

The all-fiber current transformer is a device that uses the interaction of electromagnetic field and light polarization to perform current detection. Its theoretical basis is Faraday's magneto-optical effect and Ampere’s loop law. Through the accumulation of practice in recent years, the all-fiber current transformer technology has made great progress in signal processing and demodulation algorithms, and temperature compensation of lithium niobate modulators. As users in the power industry increase their requirements for the optimization of the optical performance of devices in transformers and the maturity of process technologies such as device packaging and preparation, higher requirements are also put forward for sensing fiber optic rings. At present, several domestic enterprises and scientific research units have developed and have the ability to produce FOCT.

FOCT: Closed-loop control and interferometric reciprocity optical path technology route

By optimizing the process of key components such as optical fiber glass slides, polarization-maintaining delay loops, and polarization-maintaining optical fiber sensing cables, excellent control of the main factors of calibration, temperature performance accuracy and stability of the whole machine has been achieved.

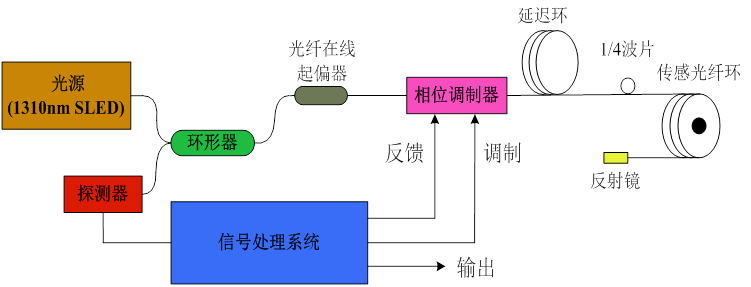

Figure 2 Technical solution of all-optical current transformer

Using closed-loop control and interferometric reciprocity optical path technology, combined with the similar demodulation method of the fiber optic gyro system, the FOCT system is realized.

Figure 3 FOCT sensor head and acquisition unit prototype

The 0.2/5P30-level FOCT products used in the power system are composed of two parts: the sensor head, the acquisition unit; and work with the merging unit.

The sensor head is installed on the current bus on the high voltage side of the power grid. It converts the current in the bus into light information related to its size, which is collected and demodulated by the collection unit, and the data is sent to the merging unit in a certain protocol format . The user only needs to read the output data of the merging unit in 100M optical fiber Ethernet mode, or use the FT3 format to output the data output by the message interface in the format specified by IEC61850-9-2 to know the size of the bus current.

Based on the above technical route and product design, FOCT products have the following characteristics:

u Simple insulation structure, anti-electromagnetic interference. The primary side is completely "optically isolated" from the acquisition and processing circuit, achieving high voltage isolation while avoiding electromagnetic interference;

u Using closed-loop control, measurement accuracy is high, dynamic range is large, and response speed is fast;

u No iron core, eliminating magnetic saturation, ferromagnetic resonance and other problems;

u Optical fiber sensitive ring structure and installation method are flexible. It can be installed at zero potential, no movement and thermal stability problems, and no danger of secondary open circuit;

u It can be used for the measurement and protection of high-voltage AC/DC transmission and transformation systems;

u Digital output, adapt to the development trend of digital, microcomputer and automation of electric power metering and protection.

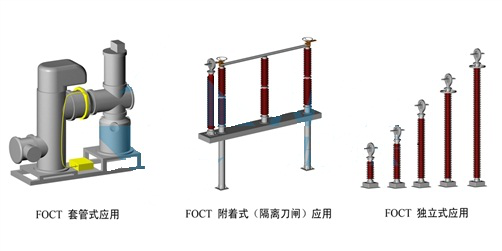

Figure 4 FOCT application scenario

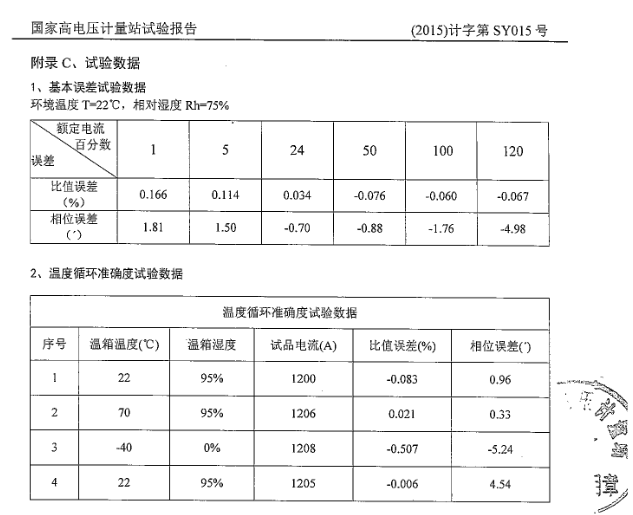

Figure 5 Third-party testing data (national high-voltage metering station)

Localization of key components

1. Preserving round fiber and preserving round fiber ring

The core component of the all-fiber current transformer is the circular fiber (ring) on the high-voltage side. This kind of fiber is a special polarization-maintaining fiber. The circular birefringence is introduced by rotating the axis of the fiber, and the high linear birefringence of the fiber itself forms an elliptical birefringence. When the rotation period is small enough, it has good circular polarization maintaining ability and is suitable for the application of fiber current mutual inductance. Due to the high internal stress, the polarization-maintaining fiber has a good ability to resist external interference and internal defects.

At present, almost all of the fiber-optic current transformer products in the domestic pilot network use imported rotating fibers, which have problems such as high unit prices, limited fiber lengths, and uncontrolled supply batches and delivery dates. YOFC is committed to promoting the research of optical fiber materials and packaging technology in optical transformers. It has invested heavily in the research of rotating optical fiber rods and drawing processes. It has also made considerable progress recently, overcoming polarization-maintaining fiber Two core problems of spinning and drawing. It is expected to realize the mass production capacity of Baoyuan sensing optical fiber as soon as possible, and plans to promote the engineering application of core components of current transformers produced nationwide.

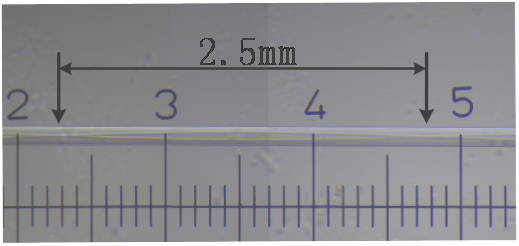

Figure 6 Micrograph of 1/2 rotation period of rotating fiber prepared by YOFC

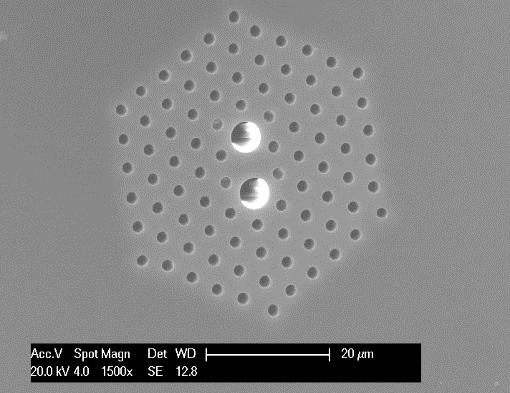

2. Polarization maintaining fiber for devices and gyroscopes, 1/4 glass plate photonic crystal polarization maintaining fiber

Figure 7 Polarization-maintaining fiber, polarization-maintaining cable and special-structure polarization-maintaining fiber

Device-type polarization-maintaining fiber-grinding cracking rate is much less than 1%

The component-type polarization-maintaining fiber has been monopolized by foreign companies for many years. The reason is that the panda-type polarization-maintaining fiber produced by domestic companies fails to solve the problem of grinding and cracking in the stress zone of the "panda eye".

Polarization maintaining fiber for fiber optic gyroscope-high polarization maintaining performance, excellent high and low temperature performance, low loss

Polarization maintaining fiber for fiber optic gyroscope has high polarization maintaining performance, excellent high and low temperature performance and low loss.

1/4 glass plate polarization-maintaining photonic crystal fiber

Source: Zhiyan Consulting Co., Ltd.

In 2018, China's fiber laser production capacity was 152,000 units, the domestic fiber laser output was approximately 127,000 units, and the domestic fiber laser capacity utilization rate was approximately 83.55%.

2. Market demand for fiber lasers

In 2018, the global laser industry showed an overall positive development trend. The Chinese laser industry has shown a steady growth trend. As the world's largest demand market for industrial lasers, the Chinese market has continued to increase in proportion, and there are about one-half of the world's industrial lasers. (Mainly fiber laser) The application market is in China. China is a big manufacturing country. With the increasing demand for automated and intelligent production models in the manufacturing industry, the demand for lasers has surged; emerging industries such as semiconductors, panels, new energy vehicles and other industries have increasing demand for laser equipment. In 2018, the industry growth rate of fiber lasers has slowed down, but the penetration rate of fiber lasers will continue to grow. The investment opportunities of fiber lasers are mainly due to the further expansion of the application market of fiber lasers with import substitution, lower prices and increased stability.

In recent years, after domestic companies have matured in technology, the industry's production and sales have achieved rapid growth in volume. Low-power fiber lasers are still the main products. The prices of medium and high-power products have gradually fallen. The application technology has gradually matured. The scope of use has gradually expanded. increase. In 2018, our country's fiber laser output reached 127,000 units, and the demand reached 14,2,500 units. The gap in production and demand has been further narrowed and the supply capacity has risen significantly, but it is still necessary to strengthen its competitiveness in terms of medium and high power.

3. Market size of fiber lasers

In general, compared with 2017, the Chinese laser market has cooled down. The entire laser equipment market has shown a trend of high and low, affected by exchange rate fluctuations, trade wars, price wars, and reduced orders from laser equipment vendors. The growth rate in the second half of the year was slower than that in the first half of the year.

In 2018, the market size of my country's fiber laser industry was 8.2 billion yuan, an increase of 3.02% from the 7.96 billion yuan in 2017.

Related report: "2019-2025 China Fiber Laser Market Operation Situation and Strategic Consulting Research Report"

4. Analysis of the development characteristics of China's fiber laser industry

(1) Import substitution is realized step by step

In recent years, as domestic companies have matured in technology, their advantages in production costs, prices, and later services have enabled domestic companies to rapidly expand their market shares, and product performance has gradually gained certain advantages, making the industry's import substitution quickly realized. In 2016, the domestic product market share expanded rapidly, and the localization rate maintained the advantage of gradual increase.

From the perspective of specific specifications of products, the import substitution of fiber lasers has maintained the order of time. In 2015, domestic fiber lasers achieved breakthroughs. In 2016, there was a heavy increase in volume, and the market share increased rapidly. Increased to around 98% in 2018. In 2015, the localization rate of medium-power fiber lasers broke through 50% in one fell swoop, accounting for 58%. In the increasingly fierce market competition, the market share of medium-power fiber lasers domestically produced products has decreased, but still maintains 50%. The above market share can be said to have established an advantage, but it is still a complete realization of import substitution. High power achieved heavy volume growth in 2018, and its proportion increased to about 33%, and there is still a lot of room for import substitution.

In general, with the maturity of domestic companies’ technology, China has already occupied most of the market share in the low- and medium-power fiber laser market, and has obvious competitive advantages. Competition in the domestic market is also becoming increasingly fierce. With the maturity of domestically produced 6 kW products, the import substitution market will be pushed to another peak. The successful introduction of 10,000-watt domestic fiber lasers will bring a successful conclusion to the competition in the alternative market in the not-too-distant future.

(2) The application is gradually widespread

At present, the fiber laser application market is still dominated by general applications such as marking and cutting. From the perspective of the application market of industrial lasers, cutting-based macro-material processing accounts for more than half of the market (55%), followed closely by It is marking and engraving. The growth of power laser cutting applications has slowed down, not because the market is saturated, but because the global manufacturing economy has slowed down, export tariffs have risen, and banks' tightening of loan interest rates has affected capital equipment expenditures.

Welding is expected to become the second largest macro-material application market. Laser welding will be the next market outlet. Because laser welding is a process that takes time to certify whether it is qualified, it takes longer to enter the market than cutting. After the efforts of the domestic laser industry in recent years, the era of massive use of laser welding is approaching.

High-power lasers have quickly entered the world, and the application range of semiconductor lasers has expanded. Nowadays, fiber lasers have become the main force of industrial lasers. Semiconductor lasers have also expanded with the expansion of the market volume of fiber lasers, and have expanded their own territory in the field of 3C electronics. , Is becoming the next technical highlight.

With the rise of emerging industries such as industrial robots, power batteries, and new energy vehicles, customized applications for specific industries, especially the welding market, will rise rapidly. Among them, metal 3D printing is still in the early stage of development, mainly due to the high material cost and slow equipment speed of metal 3D printing. However, as the cost and price of lasers drop, the application will gradually become popular, and the future development prospects are broad. Future breakthroughs in the application of fiber laser downstream industries are in the following areas: high-power cutting, welding, 3D printing, laser precision and micro processing, and laser cleaning.

(3) Medium and high power has become the main growth driver, and low power growth has stagnated

In 2018, the advanced light source market represented by fiber lasers was extremely competitive. The total annual fiber laser market sales (including imports) exceeded 8.2 billion yuan. But in fact, 10 years ago, the domestic laser market was almost monopolized by foreign companies, and 10 years later, most of China's low-power fiber laser market has been occupied by domestic manufacturers, and domestic manufacturers in the medium-power fiber laser market also accounted for more than Up 50%.

The most noteworthy thing is that in 2018, domestic high-power lasers achieved high-volume growth for the first time. In 2018, the shipment of domestic fiber lasers above 1.5kW was nearly 2,000, and the market share of domestic manufacturers increased by 15% to 35%. Among them, more than 500 units of 3kW and 3.3kW have been shipped, and more than 300 domestically produced 6kW fiber lasers have been put on the market. It is expected that the imported high-power fiber laser market will be further compressed in 2019, and the sales of domestic high-power fiber lasers will continue to rise sharply.

From the perspective of the scale of sub-specification products, although the production and sales of low-power products have expanded on a large scale in recent years, due to relatively low technical barriers and increasingly fierce competition, the growth of the industry's market scale has basically stagnated. In 2016, the scale of China's low-power fiber laser market grew rapidly to 1.627 billion yuan, while in 2018 it was only 1.65 billion yuan. In the same period, the scale of production and sales has nearly doubled, and product prices have dropped rapidly, which has greatly affected the economic benefits of low-power-based enterprises.

In contrast, the medium and high-power market, the market size in 2015 was only 1.670 billion yuan, increased to 3.321 billion yuan in 2017, and maintained a sustained and rapid growth in 2017, reaching 6.35 billion yuan. In 2018, affected by market competition and external factors, the growth of the market size has also slowed down sharply, but in general, medium and high power has become the main product of the market and the main driving force for market growth.

(4) Breakthroughs in domestic fiber laser technology have led to an overall market trend of declining prices

Before Raycus Laser was founded, my country's fiber lasers basically relied on imports, which were expensive and had a long supply cycle. The birth of Raycus series products and the emergence of Chinese fiber laser manufacturers flourishing, broke the monopoly of foreign companies in the field of fiber lasers, and directly lowered the price of imported products, forcing the price of similar imported products to drop by 50%. Take imported IPG fiber lasers as an example. In 2017, the domestic price of fiber lasers was significantly lower than the price in 2012. Take an imported 20W pulse laser as an example. The price per unit was about 9-12. Ten thousand yuan has now fallen to around 30,000 yuan.

At present, the price of Raycus's low-power fiber lasers of 10 to 30W will be 40% to 50% lower than similar imported fiber lasers. In addition to small and medium power lasers, the proportion of fiber lasers above the kilowatt level in China is constantly increasing. Although high-power lasers have significant advantages in terms of stability, lifespan, and power consumption, they are also quite expensive.

With the more and more widespread application of laser technology and the gradual mastery of laser technology by domestic enterprises, the price of lasers today is far from the high price level of the monopoly period of foreign products. Judging from the selling prices of major lasers in the domestic market, the price of fiber lasers with an average power of less than 30W is less than 100,000 yuan, and the price of imported lasers is significantly higher than that of domestic lasers. The price of CO2 lasers within 100W does not exceed 100,000 yuan. The price of 10-20W low-power CO2 lasers and infrared lasers does not exceed 30,000 yuan.

On the whole, the average price of my country's fiber laser market has shown a downward trend, from 80,907.94 yuan/unit in 2013 to 57,543.86 yuan/unit in 2018.